How to Register a US Company as a non-resident | How to open a US bank account as a non-resident

ලංකාවේ සිට ඇමෙරිකාවේ සමාගමක් ලියාපදිංචි කරන්නේ කෙසේද? ලංකාවේ සිට ඇමෙරිකාවේ බැංකු ගිනුමක් ආරම්භ කරන්නේ කෙසේද? ලංකාවේ සිට පේපැල් හෝ ස්ට්රයිප් නීත්යානුකූලව ලබාගන්නේ කෙසේද?

සිංහල සාරාංශය - ඔබ ඇමෙරිකාවෙන් පිට ජීවත්වෙන ඇමෙරිකානු පුරවැසියෙක් නොවේ නම්, ඔබ වෙනුවෙන් ඇමෙරිකාවේ නියෝජිතයෙක් මගින් සමාගමක් ලියාපදිංචි කර ඒ සඳහා සමාගම් බැංකු ගිනුමක් ආරම්භ කල හැක.

ඇමෙරිකාවේ විවිධ ප්රාන්ත වල සමාගම් ලියාපදිංචි ගාස්තු වෙනස් වෙන නිසා, ඉතාම අඩු මුදලකට එය කලහැක්කේ ඩෙල්වෙයා ප්රාන්තයේයි.

ඔබ විසින් පත්කරනු ලබන නියෝජිත හෝ සේවා ආයතන මගින් ඔබ වෙනුවෙන් සමාගම් නමක් අනුමත කරගැනීම, ඔබට ඇත්තම ලිපිනයක් ලබාදීම, ඔබ වෙනුවෙන් සමාගම ලියාපදිංචියට අවශ්ය ලේඛන භාරදීම සහ ලියාපදිංචි සහතික ලබාගැනීම, සමාගම් බදු ලිපිගොනු අංකයක් ලබාගැනීම සහ ඊ අයි එන් (EIN) අංකයක් ලබා ගැනීම වැනි කරුනු සිදු කරයි.

මෙයින් පසු නියෝජිතයන් විසින් ඇත්තම ඇමෙරිකානු බැන්කුවක ගිනුමක් ආරම්භ කරයි. මෙම සමාගම මගින් ඔබට ඇමෙරිකාවේ ව්යාපාර කිරීමටත්, පේපැල්, ස්ට්රයිප් වැනි පහසුකම් නීත්යානුකූලව ලබාගැනීමටත් හැකියි.

මෙවැනි සේවා 2ක් මම පහලින්ම දක්වා ඇත. ස්ට්රයිප් ඇට්ලස් සහ ඩූලා වැනි සේවාවන් මගින් ඉක්මනින් මේ කටයුතු සිදුකරගත හැක.

ඇමෙරිකාවේ සමාගමක් ලියාපදිංචියෙන් ඔබට ජාත්යන්තර ව්යාපාරයක් වර්ධනය කරගැනීම හරහා විකිනුම් වැඩිකර ගැනීමට අඩිතාලමක් වනු නොඅනුමානය.

Starting a U.S.-based business as a foreigner can be a long road, but the country makes it easy to register your company and open your business. Learning English is a basic requirement if you plan on doing business with Americans, but other aspects such as filing for your Employer Identification Number (EIN), and choosing which type of company you want to be, can make matters more confusing.

Choose Your Company Structure

Most foreign nationals, says Schwartz International tax advisor and lawyer Richard Hartnig, choose to establish a C corporation, which can expand by offering unlimited stock and is typically more attractive to outside investors, even though its profits are taxed twice, first at the corporate level, and then as dividends to shareholders.

For corporate shareholders, the advantages are usually clear: Corporate shareholders typically qualify for a lower dividend rate. And so long as the U.S. company doesn’t primarily hold real estate, the corporate parent won’t pay capital gains when it sells the U.S. affiliate. Even individual foreign owners are probably best off with a C corporation, says Hartnig, since the structure will shield them from direct IRS scrutiny. “Foreign individuals are very, very hesitant to put their names on the U.S. tax rolls,” he says.

Of course, C corporation owners pay more for that shield as a result of the double tax. But in many cases, tax planners can use salaries, pension costs, and other expenses to reduce corporate income and eliminate much of the double taxation.

All that said, in some cases–usually depending on the particulars of one’s native tax laws–a limited partnership may be the best business structure. In a limited partnership, partners without management control have limited liability, and profits are passed through to the members, who pay income tax on their individual tax return.

Choose a State to Register Your Company In

The company’s business should determine where it locates. If one state dominates its market, it’s best off incorporating there–there’s no way to avoid obligations of doing business in, say, California, a famously high-cost jurisdiction, by registering in Nevada or Delaware, two famously low-burden states. On the other hand, if the business will not be concentrated in any particular state, most advisors will probably recommend Delaware incorporation, followed by Nevada.

This is in part because of Delaware’s “flexible” corporate law that offers generous protections to shareholders and directors, and also due to its outsider-friendly rules. (Besides not requiring either a local physical address or bank account, Delaware makes its corporate law website available in 10 languages.) It’s also, at least in part, a matter of inertia: Tax advisors are so familiar with Delaware’s welcoming ways that many haven’t bothered to learn the requirements of more far-flung states.

Register

The forms and other requirements for forming a business entity vary somewhat by state. Here’s how incorporation works in Delaware, which serves as a simplified model for many states:

- The company principals choose a unique name.

- They select a registered agent that is able to receive legal documents for the company. (A company with a physical address in the state can serve as its own agent, but this is not true in other states, like California.)

- The company fills out a one-page certificate of incorporation that identifies the corporate name, the name and address of its registered agent, the total amount and par value of the shares the corporation is authorized to issue, and the name and mailing address of the incorporator. Fees start at $89 and increase principally based on the amount of stock issued or capital raised.12

Once the business is incorporated, it must file a report ($50) and pay franchise tax (from $175) annually. Though many online services exist to help with entity formation for a separate fee that can reach several hundred dollars, the paperwork is generally fairly straightforward, and states (usually through their secretary of state) normally provide guidance online to help individuals file the proper paperwork.

Obtain an Employer Identification Number

An Employer Identification Number (EIN) is necessary not just to hire workers but to open a bank account, pay taxes, or often to get a business license. Apply for the EIN for free directly with the IRS, and avoid the many online services with government-sounding internet addresses that charge for this service. But unless the U.S. company’s principal officer (who the IRS calls the “responsible party”) has already obtained a separate Taxpayer Identification Number from the agency, it can’t apply for an EIN online–it must apply by mail or FAX, and where the form asks for the Taxpayer Identification Number, enter “foreign/none.”3

Once you have obtained an EIN, you should consider comparison shopping to find a business bank account that fulfills your specific needs. Some key factors to review include rewards, access to brick-and-mortar and online services, the convenience of making cash deposits, and the ability to earn attractive interest rates on your deposits.

Types of US bank account

There are two main types of US bank account, and each one serves a different kind of client. The first type of account focuses on the individual and the other targets businesses.

Personal account (This is not relevent for this topic)

The first type of bank account is a personal account.

A personal account is for reaching your individual financial goals. Saving up for a big purchase like a house or accumulating interest on your earnings for example. Both checking and savings accounts fall into this category.

The checking account is the most common bank account, and it’s the first one you’ll want to set up. This should be the account for your main income and expenses.

You can deposit money with a savings account that you don’t plan on spending right away. The money in this account gains interest over time, though it isn’t free money since interest is taxable income.

Corporate account (This is what is relevent here)

The other main type of account is a corporate account.

As the name suggests, the corporate account is for businesses. With it, you can keep your transactions under wraps and your business information private.

The privacy adds a layer of protection to your business’ finances, making things more secure. It also allows you to give someone else the power to complete transactions on your behalf.

Now that it allowes Corporate to open USA Bank account through a representative in US, below are two popular services that you can use to register your company and open bank account. Having done, you get access to open your Payment Gateway like PayPal and Stripe leagally.

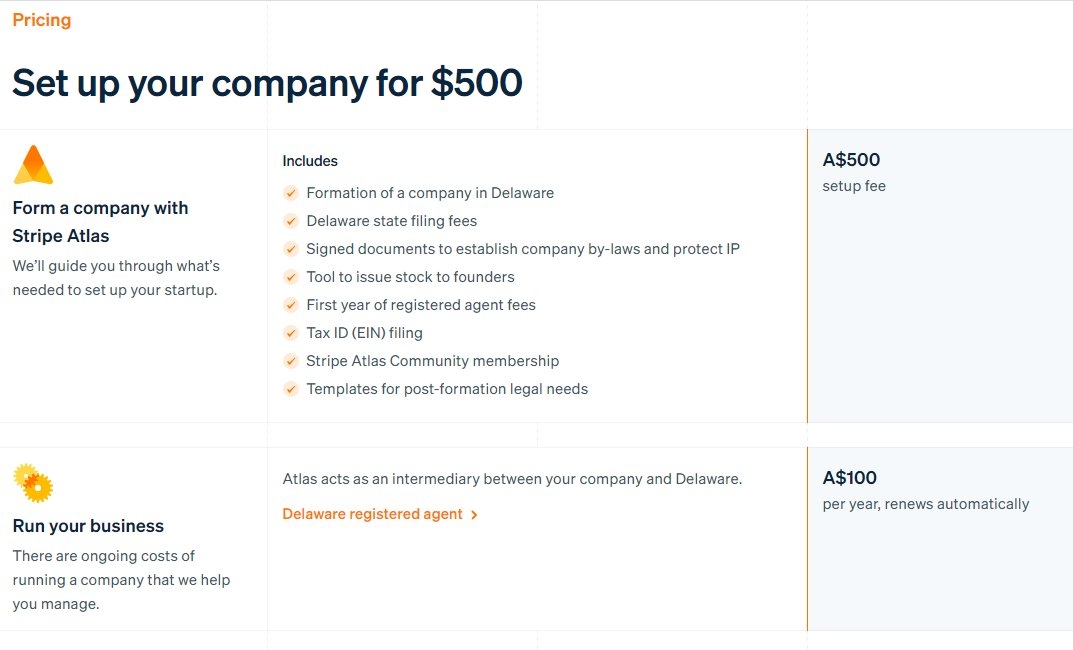

Stripe Atlas

Stripe Atlas is a powerful, safe, and easy-to-use platform for forming a company. By removing lengthy paperwork, legal complexity, and numerous fees, Stripe Atlas helps you launch your startup from anywhere in the world.

Doola

Doola is a company that can help you incorporate a business in the United States, keep it compliant and legal year-over-year, and get paid easily via your bank, Stripe, or PayPal. Register your US company in less than 10 minutes.

Compile by Diluka Weerasingha CA on 30th April 2022 (Source: Investopedia, Wise, Stripe and Doola)

Arabic

Arabic

English

English  Russian

Russian  French

French  Español

Español  Turkish

Turkish  German

German